Understanding the interplay between covariance forecasting factor models and risk‐based portfolio allocations in currency carry trades - Ames - 2018 - Journal of Forecasting - Wiley Online Library

PDF) Forecasting Correlation and Covariance with a Range-Based Dynamic Conditional Correlation Model

Quantile treatment effects in difference in differences models with panel data - Callaway - 2019 - Quantitative Economics - Wiley Online Library

JRFM | Free Full-Text | Improved Covariance Matrix Estimation for Portfolio Risk Measurement: A Review | HTML

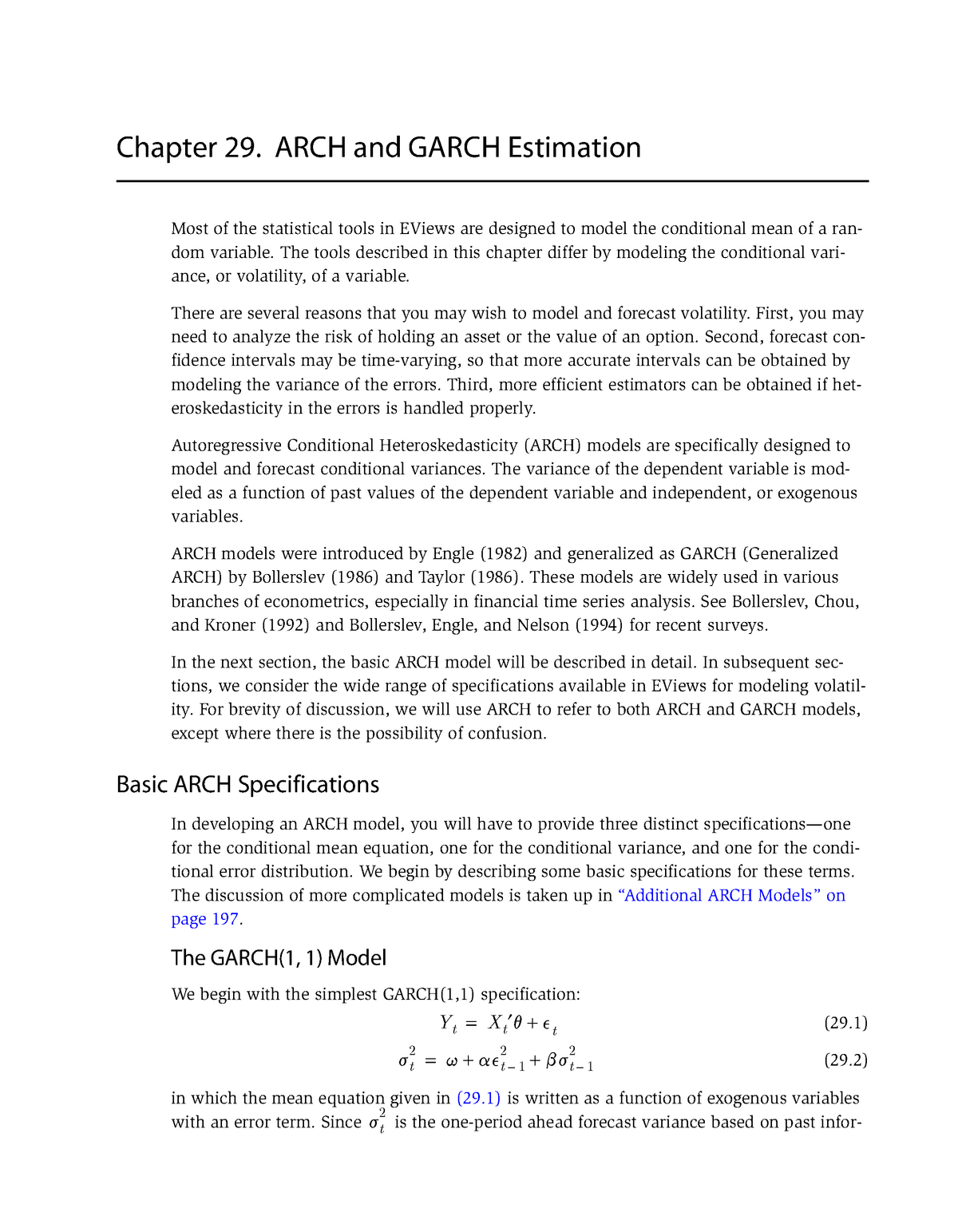

EViews 6 Users Guide II Garch - Chapter 29. ARCH and GARCH Estimation Most of the statistical tools - StuDocu

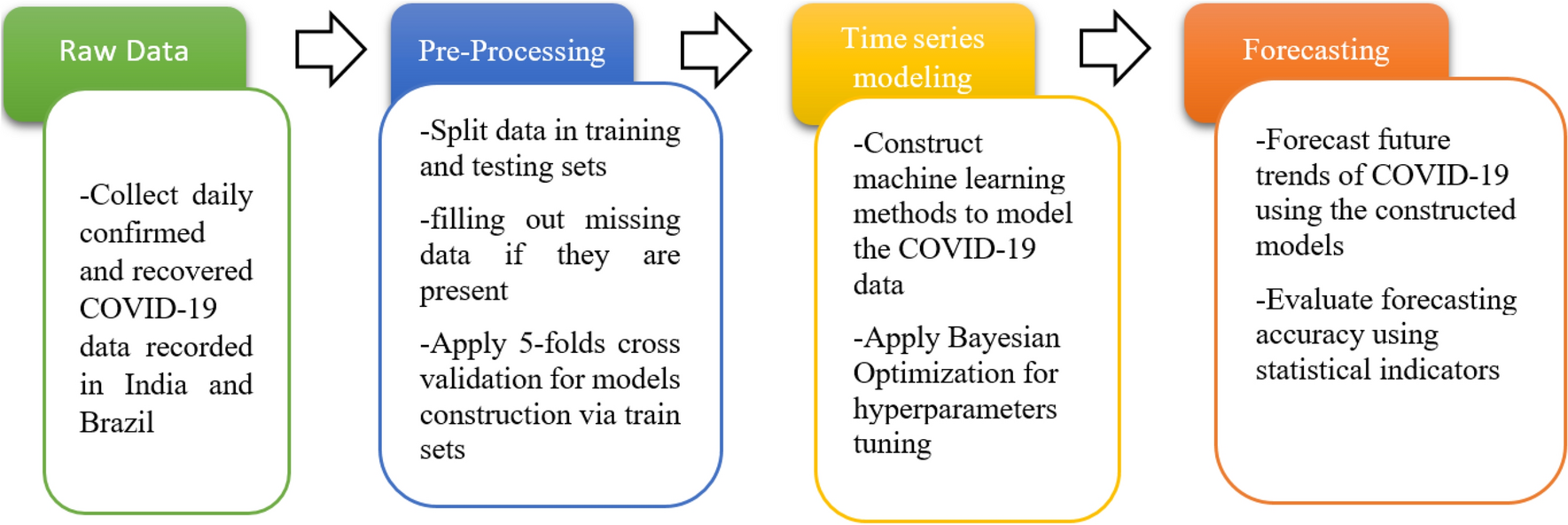

A proficient approach to forecast COVID-19 spread via optimized dynamic machine learning models | Scientific Reports

PDF) Modelling and Forecasting Conditional Covariances: DCC and Multivariate GARCH | michelle mangwanya - Academia.edu

:max_bytes(150000):strip_icc()/Variance-CovarianceMethod5-5bde86ce7819405ca63f26aa275a4bd2.png)